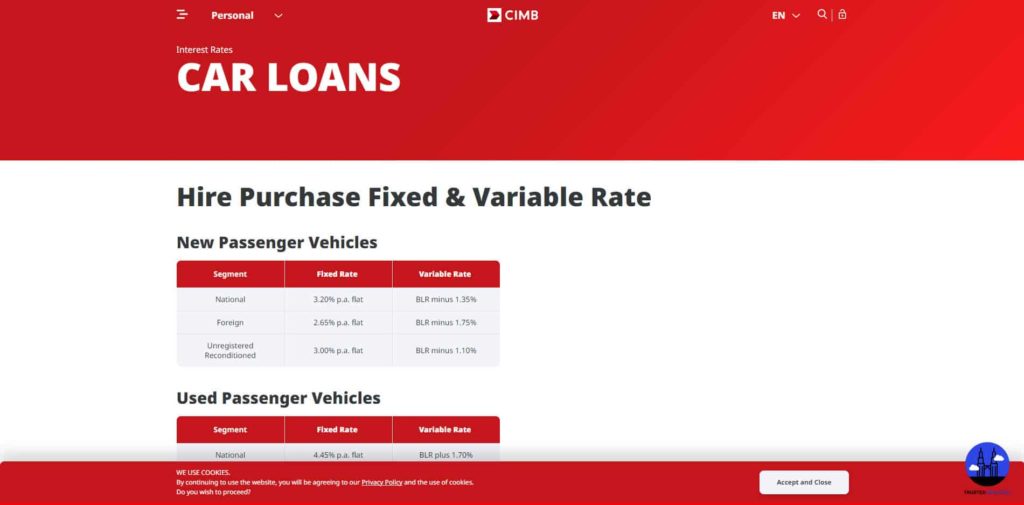

Current Bank Car Loan Rate Malaysia

Most banks will allow you to pre-qualify before you start shopping for a used car. CIMB BANK BERHAD 197201001799 13491-P.

This reduces the risk for the bank and allows them to drop the interest rate.

. Bank Name Car Loan Interest Rates. Malaysia car loan calculator to calculate monthly loan repayments. Compare Interest Rate by Country.

If you decide to pay RM2000 in one particular month instead of RM1875 the. Look for lenders that keep fees to a minimum and. Amount of each instalment or the number of instalments shall be revised whenever there is a BLR revision.

Bank Muamalat Hire Purchase-i. Alliance Bank Hire Purchase. This special promotion is valid until 31.

Principal Loan Amount Interest 60 Months RM1875. A 5-year fixed-rate new car loan for 37000 would have 60 monthly payments of 688 each at an annual percentage rate APR of 434. Fixed rate car loan with simple interest method left Rule of 78 method right Now lets assume after two years you want to pay off the remainder of the loan at which.

AmBank Arif Hire Purchase-i. Compare Car Loans in Malaysia 2022. Please confirm the rates or charges with the respective banking institution.

A 5-year fixed-rate used car loan for 25000 would have 60 monthly payments of 467 each at an annual percentage rate APR of 454. When shopping for an auto loan compare APRs annual percentage rates across multiple lenders to make sure youre getting a competitive rate. CIMB Flood Relief Assistance Plan.

Based on fixed interest rate per annum flat. APR or the annual percentage rate. For more details contact the nearest CIMB Auto Finance Centre.

Purchase a brand new or used cars and easily compare Car Loan Interest rates for the vehicle you need. Generate car loan estimates tables and charts and save as PDF file. Based on a margin above the Banks Base Lending Rate BLR Based on fixed interest rate per annum flat.

Report Interest Rates On Auto Loans Will Decline Further In 2021 Kelley Blue Book Compare Car Loans in Malaysia 2022. The Hire Purchase Interest Rates are currently being updated. Your Principal Loan Amount.

For loan periods that are five years or less Carsome customers are eligible to get super low rates depending on their loan amount which are 099 for RM30000 to RM40000 199 for RM40001 to RM50000 and 219 for RM50001 and above while six to seven years are at 268 and eight to nine years are at 288. CIMBs market views on Malaysias State of Emergency. 25 x RM100000 x 5 Years RM12500.

Example of How Conventional Car Loan Works.

Base Rate Br Base Lending Rate Blr Standardised Base Rate Sbr All You Need To Know

New Reference Rate In Malaysia Effective 2nd January 2015 Base Rate Br

A Guide To Car Loans Interest Rates In Malaysia

Base Rate Br Base Lending Rate Blr Standardised Base Rate Sbr All You Need To Know

2019 Bank Mortgage Interest Rates Malaysia

5 Banks That Offer The Best Car Loan In Malaysia 2022

0 Response to "Current Bank Car Loan Rate Malaysia"

Post a Comment